Google Ad Manager Optimization: Advanced Configuration Guide

In the complex and ever-evolving world of digital publishing, your ad server is the central nervous system of your revenue strategy. For the vast majority of publishers, that system is Google Ad Manager (GAM). But simply having GAM in place is like owning a high-performance race car and only ever driving it in first gear. To truly unlock its potential and maximize every impression, you need to move beyond the basic setup and dive deep into its advanced configuration capabilities.

The programmatic landscape is fiercely competitive. Industry reports suggest that publishers can leave anywhere from 15-30% of potential revenue on the table due to suboptimal ad server configurations. This isn't just about placing ad tags on a page; it's about engineering a sophisticated, real-time auction environment where every demand source competes fairly and aggressively for your inventory. This guide will walk you through the advanced configurations, best practices, and strategic thinking required to transform your Google Ad Manager account from a simple ad serving tool into a powerful revenue optimization engine. We'll explore the core concepts of dynamic allocation, the critical role of yield groups, and provide a technical roadmap for implementation.

The Modern Ad Stack: Why Advanced GAM Optimization is Non-Negotiable

The days of the rigid, sequential "waterfall" are largely behind us. In a traditional waterfall, ad networks were called one by one in a predetermined order based on historical CPMs. If the first network didn't have an ad, the call passed to the second, and so on. This process was slow, inefficient, and often left money on the table because a network lower in the chain might have been willing to pay more for a specific impression but never got the chance.

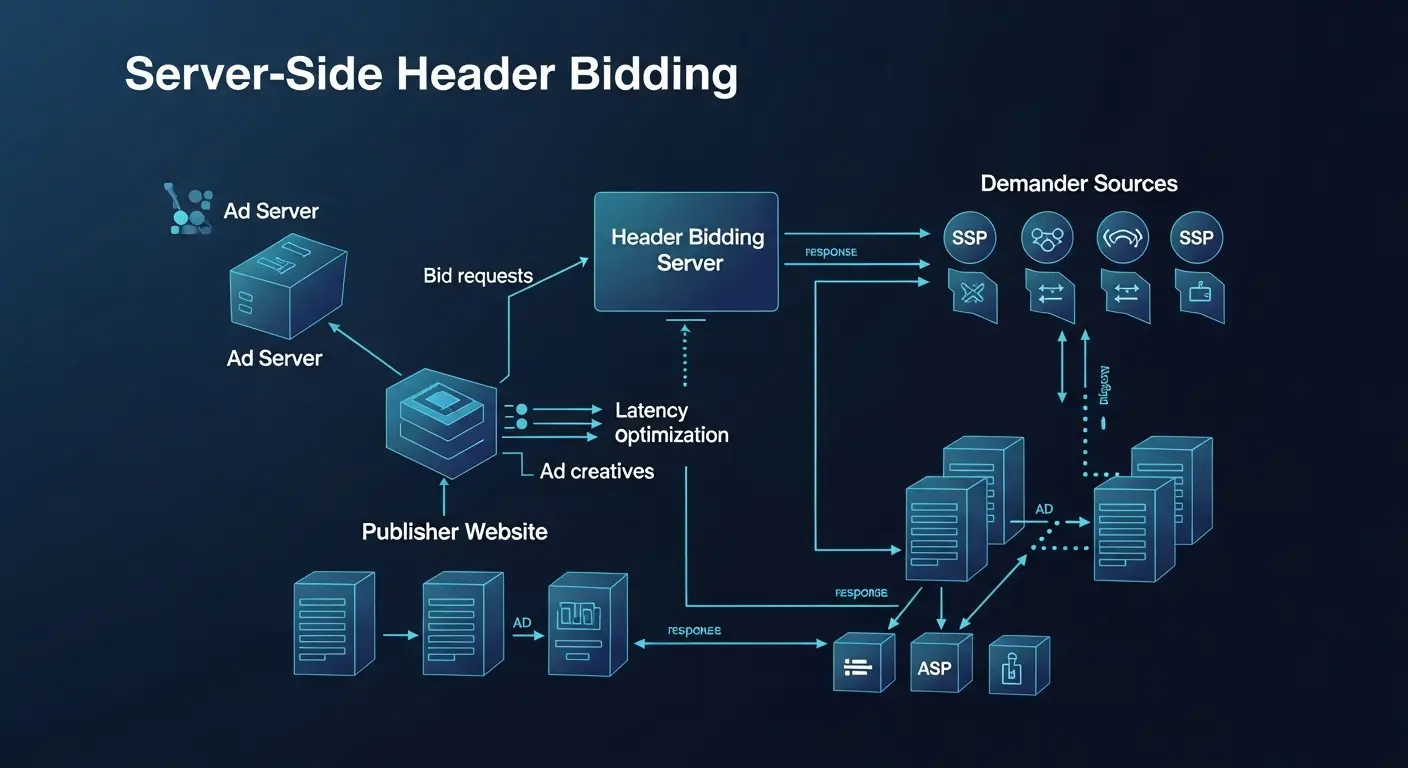

Today, the industry has embraced a unified auction model. The goal is to have as many demand partners as possible bid on an impression simultaneously, ensuring the highest bidder always wins. This is where technologies like header bidding and Google's own Open Bidding (formerly Exchange Bidding) come into play. GAM is the arena where this unified auction takes place. A properly configured GAM account ensures that Google's own demand (from the Ad Exchange) competes on equal footing with your other partners, driving up competition and, consequently, your CPMs.

Furthermore, the digital advertising ecosystem is in constant flux. The rise of new ad formats, the increasing importance of user experience, and evolving privacy regulations all demand a more sophisticated approach. Your GAM setup needs to be agile enough to adapt to these changes, allowing you to test, learn, and optimize continuously.

Foundational Excellence: Prerequisite for Advanced Optimization

Before diving into yield groups and dynamic allocation, it's crucial to ensure your foundational GAM setup is solid. Advanced strategies built on a weak foundation will inevitably crumble. Here are the key pillars to review:

1. A Granular and Logical Ad Unit Structure: Your ad units are the building blocks of your inventory. A common mistake is being either too broad (e.g., one ad unit for all 728x90 ads on the site) or too chaotic.

- Best Practice: Create a clear, hierarchical naming convention. A good format is

Domain_PageType_Position_Size. For example:YourSite_Article_Top-Leaderboard_728x90. - Why it Matters: This granularity allows for precise targeting, targeted pricing rules, and, most importantly, detailed reporting. You can easily identify which placements are performing best and which need attention. This detailed insight is fundamental to any data-driven growth strategy, a topic we explore further in our analytics guide.

2. Strategic Use of Key-Value Targeting: Key-values are GAM's superpower for creating custom targeting criteria. You can pass specific attributes about the page or user into the ad tag, allowing you to segment your inventory in powerful ways.

- Examples:

article_category=sportsuser_status=logged-inviewability_score=high(if you use a tool to predict viewability)

- Implementation: Work with your development team to pass this information into the

googletagdefinition on your page. You can then use these key-values to set specific pricing rules or aim direct-sold campaigns at highly valuable audience segments.

3. Unified Pricing Rules (UPRs): The New Standard for Floor Prices Forget the old "Ad Exchange Rules." Unified Pricing Rules are the modern way to manage pricing across all indirect demand in your unified auction, including the Google Ad Exchange, Open Bidding partners, and even remnant line items.

- Function: UPRs allow you to set floor prices (minimum acceptable CPMs) for specific segments of your inventory. You can target these rules using the same criteria as line items: ad units, key-values, geography, device type, etc.

- Strategy: Start with a conservative floor price to protect your inventory's value without harming fill rate. As you gather data, you can A/B test different floors for different inventory segments to find the sweet spot between CPM and fill. You can set a "hard floor" (no bid below this price will be accepted) or a "Target CPM" (which allows Google's algorithm some flexibility to optimize for long-term revenue).

The Core of Revenue Maximization: Dynamic Allocation and Yield Groups

This is where the real power of GAM optimization lies. Understanding and correctly implementing Dynamic Allocation and Yield Groups is the single most impactful thing you can do to increase your programmatic revenue.

What is Dynamic Allocation?

Dynamic Allocation is Google's proprietary technology that allows demand from Google Ad Exchange and AdSense to compete in real-time against your other demand sources set up in GAM. It's the mechanism that breaks the rigid waterfall and creates a more competitive auction.

Here’s how it works in a simplified scenario:

- A user visits your page, and an ad request is sent to GAM.

- GAM checks for any Guaranteed campaigns (like direct-sold sponsorships) that are eligible. If one exists and is on schedule, it wins.

- If no Guaranteed campaign is eligible, GAM looks at your non-Guaranteed demand, including remnant line items and Yield Groups.

- GAM identifies the highest-paying remnant line item that is eligible to serve. Let's say it's a third-party ad network line item with a rate of $2.00 CPM.

- This is the crucial step: Before serving that $2.00 line item, Dynamic Allocation gives Google Ad Exchange a "last look." It essentially asks, "Can you beat $2.01?"

- If Ad Exchange has a bid higher than $2.01, it wins the impression. If not, the $2.00 line item from the third-party network serves.

This process ensures that you never serve a lower-paying remnant ad when Google was willing to pay more. It's the first step toward a unified auction.

What are Yield Groups?

Yield Groups are the evolution of Dynamic Allocation. They are the primary tool within GAM for managing your non-Guaranteed, auction-based demand sources. A Yield Group allows you to bring multiple ad networks and exchanges (known as "Yield Partners") together to compete for your inventory in a single, unified auction.

Instead of just letting Ad Exchange compete with your remnant line items, a Yield Group lets Ad Exchange, Open Bidding partners, and mobile app mediation networks all compete at the same time.

Key Benefits of Yield Groups:

- Increased Competition: More bidders in a single auction naturally drive up the price.

- Efficiency: It’s a much cleaner and more efficient setup than a complex waterfall of dozens of line items.

- Transparency: Reporting is more straightforward, allowing you to see how each yield partner is performing.

Technical Implementation: Setting Up and Optimizing Your First Yield Group

Let's walk through the process of creating a Yield Group for your web inventory to bring Open Bidding partners into competition with Google Ad Exchange.

Step 1: Link Your Ad Exchange Account This is typically done by default in modern GAM accounts. You can verify by navigating to Admin > Linked Accounts. Your Ad Exchange account should be listed and active.

Step 2: Add Open Bidding Partners Before you can add them to a Yield Group, you need to add Open Bidding partners to your GAM network.

- Go to Admin > Companies.

- Click New Company > Ad network.

- Find and select the exchanges you have a contractual relationship with (e.g., Xandr, Magnite, Index Exchange).

- Check the box for "Enable for Open Bidding" and follow the prompts to link your accounts. This usually involves providing an account ID or other credentials from that partner.

Step 3: Create the Yield Group

- Navigate to Delivery > Yield Groups.

- Click New yield group.

- Name: Use a clear, descriptive naming convention. E.g.,

Web_All-Geo_Display_Open-Bidding. - Ad format: Select the relevant format. For standard banners, this is "Display". For other formats, you might choose "Video" or "Native".

- Inventory type: Select "Web".

- Inventory sizes: Add all the ad unit sizes this group will target (e.g., 728x90, 300x250, 300x600).

- Targeting: This is the most critical part. Your Yield Group targeting must match the inventory you want it to apply to.

- Start by targeting the ad units you created with your granular structure.

- Add any other relevant targeting, such as Geography, Device, or Key-Values. Be specific. You might create separate Yield Groups for US traffic vs. European traffic, or for your homepage vs. article pages, if your demand partners perform differently in those segments.

Step 4: Add Yield Partners to the Group

This is where you build your auction.

- In the "Yield partners" section, click Add yield partner.

- Ad Exchange: By default, Google Ad Exchange will be an option. Select it. It is automatically included and will compete dynamically. There's no CPM to enter; it bids in real time.

- Open Bidding Partners: Click Add yield partner again. Select one of the Open Bidding partners you enabled in Step 2. Repeat for all the partners you want in this group.

- Integration Type: This will be "Open Bidding".

Step 5: Configure Header Bidding (Optional but Recommended)

While Open Bidding is Google's server-side solution, many publishers still get significant demand from a client-side header bidding setup using Prebid.js. Integrating this into the auction is a bit different but follows the same competitive principle.

- You will create separate "mirror" line items in GAM for each bidder and each price point (e.g., using price granularity of $0.10 increments).

- Your Prebid setup on-page will conduct its auction, and the winning bid price is passed to GAM as a key-value (e.g.,

hb_pb=5.50). - The line item that targets the

hb_pb=5.50key-value will be eligible to serve. - Dynamic Allocation then ensures that this $5.50 line item competes with Ad Exchange and your Yield Group partners. If Ad Exchange can beat $5.51, it wins. Otherwise, the header bidding line item serves.

This hybrid approach, combining Yield Groups for Open Bidding with a well-structured set of line items for Header Bidding, creates the most competitive auction environment possible.

Advanced Optimization Strategies

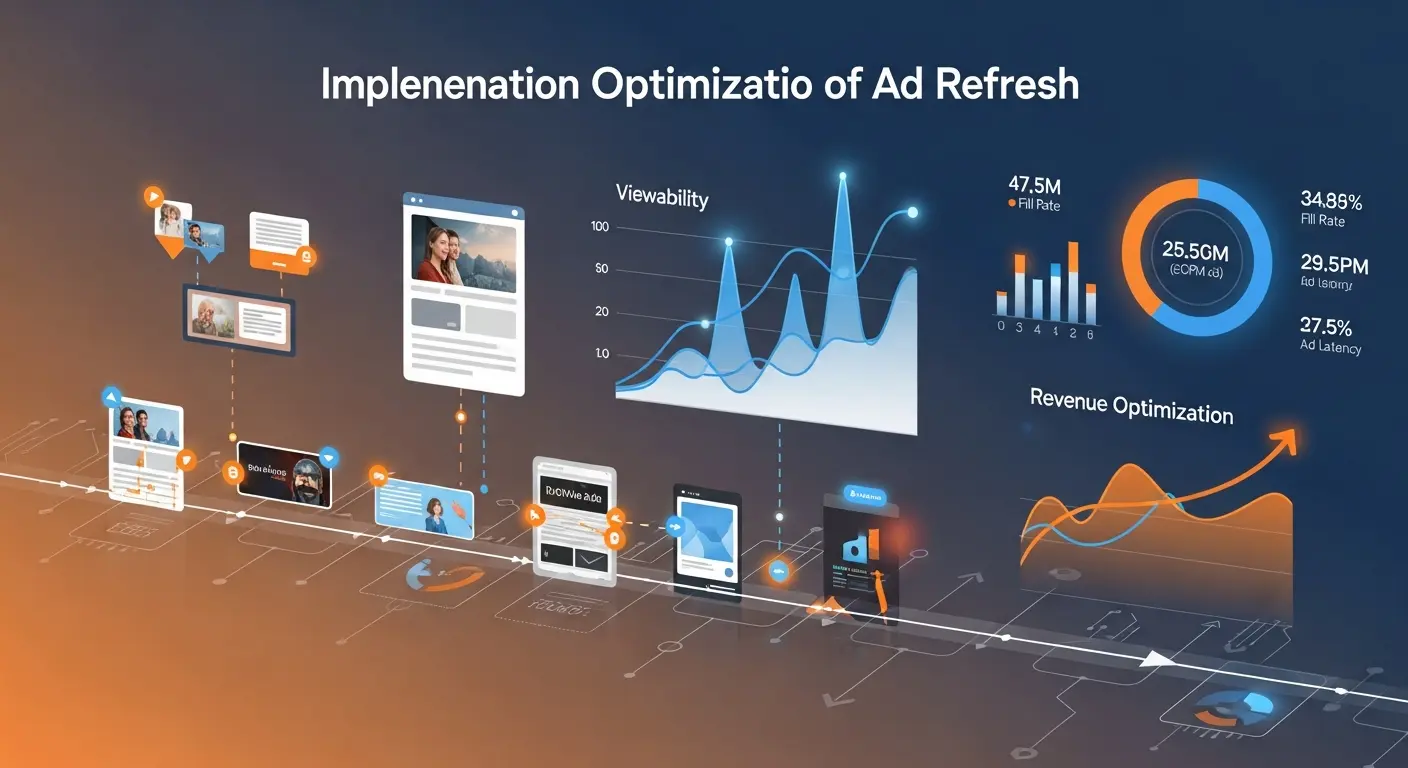

Creating the Yield Group is just the beginning. The real work is in the ongoing optimization.

- Analyze Performance: Regularly run GAM reports on your Yield Groups. Navigate to Reporting > Reports > Yield group. Key metrics to watch are:

- Yield Group CPM: The effective CPM for the group.

- Fill Rate: The percentage of requests filled by the group.

- Estimated Revenue: The total revenue generated.

- Drill down by "Yield partner" to see who is winning and at what price. If a partner consistently provides low or no bids, you may consider removing them.

- Test Unified Pricing Rules: Use your UPRs in conjunction with your Yield Groups. Test different floor prices for different segments. For example, your US desktop traffic can likely sustain a higher floor than your RoW (Rest of World) mobile web traffic. A/B test a $1.00 floor vs. a $1.25 floor on a specific ad unit and measure the impact on both CPM and total revenue.

- Add More Partners: The more competition, the better. Continually evaluate and onboard new Open Bidding partners to see if they can add incremental value and drive up the auction price for your inventory.

Beyond Standard Banners: Rich Media and Specialized Inventory

While the principles above apply universally, certain inventory types require special consideration.

- Video Ads: Monetizing video ads introduces complexities like VAST/VPAID standards, latency, and ad pods. You can create specific Yield Groups for your instream video inventory. Competition is key here, as video CPMs are high, and ensuring multiple demand sources are bidding can dramatically increase revenue per stream.

- Mobile App Monetization: For mobile apps, the concept is similar but the technology is called mediation. You create a Mediation group (the app equivalent of a Yield Group) and add SDK-based ad networks. GAM then calls these networks and awards the impression to the highest payer. This is a core component of any successful app monetization strategy. Our solutions for ad mediation are designed to simplify this complex setup.

- Ad Layout and Viewability: Your GAM configuration is only half the battle. If your ads are not viewable, they won't command high CPMs. A well-optimized GAM setup paired with strategic ad layout optimization is a winning combination. Ensure ads are placed above-the-fold or in high-attention areas of the page.

Common and Costly Mistakes to Avoid

- Over-Targeting Yield Groups: Making your targeting so specific that the group applies to very few impressions. This can limit competition and make performance data statistically insignificant. Start broader and only get more granular if data supports it.

- Setting Floors Too High: It's tempting to set high floor prices to boost CPMs, but this can crush your fill rate and lead to a net loss in revenue. Always test floor changes carefully and monitor the impact on both metrics.

- Ignoring Ad Quality: Allowing low-quality or malicious ads through your system can harm user experience, driving visitors away and reducing your long-term revenue potential. Use GAM's Protections and the Ad Review Center diligently.

- "Set It and Forget It" Mentality: The programmatic ecosystem changes daily. New bidders emerge, old ones change algorithms. You should be reviewing your Yield Group and UPR performance at least weekly and making iterative, data-backed adjustments.

- Not Diversifying Demand: Relying solely on Google Ad Exchange is a common mistake. By integrating multiple Open Bidding and Header Bidding partners, you create a hedge against any single demand source's performance dips and foster a more competitive, higher-yielding auction.

Conclusion: Your Path to Revenue Mastery

Google Ad Manager is an incredibly powerful platform, but its full potential is only realized through active, intelligent, and advanced configuration. By moving away from outdated waterfall models and fully embracing the unified auction via Yield Groups and Dynamic Allocation, you place your inventory in the most competitive environment possible.

This requires a commitment to a granular setup, strategic pricing, continuous testing, and detailed analysis. The process can seem daunting, but the impact on your bottom line is undeniable. By treating your ad server not as a passive tool but as a dynamic engine for growth, you can ensure you are capturing the maximum value for every single impression.

If you're ready to unlock the full potential of your ad inventory but need expert guidance to navigate the technical complexities, our team is here to help. We specialize in turning ad operations into a powerful competitive advantage. Feel free to contact our team for a consultation, book a demo to see our technology in action, or explore our solutions to learn more about how we empower publishers to thrive.